Contents:

Are the value of your assets and liabilities now zero because of the start of a new year? Your car, electronics, and furniture did not suddenly lose all their value, and unfortunately, you still have outstanding debt. Having a zero balance in these accounts is important so a company can compare performance across periods, particularly with income. It also helps the company keep thorough records of account balances affecting retained earnings.

- When every step has been completed, it’s time to create a report and close the books.

- Importantly, according to the accounting balancing principle, any posting document should net to a balance of zero.

- Other accounting information– Profit center, posting line description etc.

Revenue is one of the four accounts that needs to be closed to the income summary account. While these accounts remain on the books, their balance is reset to zero each month, which is done using closing entries. The net balance of the income summary account would be the net profit or net loss incurred during the period.

Managerial Accounting

Working in an organized manner is always better than working haphazardly, especially when it comes to financial tasks. When it comes to month-end close, even the most organized person is susceptible to missing crucial steps or making mistakes. In your accounting software, confirm that you have entered each and every customer invoice for the month.

Learn more about this topic, accounting and related others by exploring similar questions and additional content below. INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more. Here is that any profit earned during the period needs to be retained for use in future company investments. Manual approach – It is called a manual bank statement, which has the same logic but everything is manually performed by the user. Automatic approach – It is called electronic bank statement where the system imports all the electronic statements automatically into SAP HANA and then reconciles and matches them. Other accounting information– Profit center, posting line description etc.

Closing entries

Close the income statement accounts with debit balances to the income summary account. After all revenue and expense accounts are closed, the income summary account’s balance equals the company’s net income or loss for the period. Companies use closing entries to reset the balances of temporary accounts − accounts that show balances over a single accounting period − to zero. By doing so, the company moves these balances into permanent accounts on the balance sheet. These permanent accounts show a company’s long-standing financials.

Third, the income summary account is closed and credited to retained earnings. Any account listed on the balance sheet, barring paid dividends, is a permanent account. On the balance sheet, $75 of cash held today is still valued at $75 next year, even if it is not spent. Close the income summary account by debiting income summary and crediting retained earnings. The income summary is a temporary account used to make closing entries. If the balance in Income Summary before closing is a credit balance, you will debit Income Summary and credit Retained Earnings in the closing entry.

1 Describe and Prepare Closing Entries for a Business

If income summary account has a credit balance, it means the business has earned a profit during the period which causes an increase in retained earnings. Therefore, the income summary account is closed by debiting income summary account and crediting retained earnings account. Permanent accounts, on the other hand, track activities that extend beyond the current accounting period. They are housed on the balance sheet, a section of the financial statements that gives investors an indication of a company’s value, including its assets and liabilities. A closing entry is a journal entry that is made at the end of an accounting period to transfer balances from a temporary account to a permanent account.

And so, the amounts in one depreciable assetsing period should be closed so that they won’t get mixed with those in the next period. Now for this step, we need to get the balance of the Income Summary account. In step 1, we credited it for $9,850 and debited it in step 2 for $8,790. Temporary accounts include all revenue and expense accounts, and also withdrawal accounts of owner/s in the case of sole proprietorships and partnerships . The bank reconciliation function is the process during which all the bank statement transactions are settled with all the transactions posted in the general ledger account. Business Partners are the external party with whom your company performs bank accounting transactions.

For example, core SAP tasks and a complete list of close tasks can be maintained and managed in SAP AFC or SAP FCc. Yes, many corporate accountants use a month-end checklist to ensure that all required tasks are completed correctly and on time during the month-end closing process. The month-end checklist is essential because it ensures that all necessary tasks are completed correctly and on time, resulting in accurate financial statements. It is critical for making sound business decisions and adhering to regulatory requirements. Closing entries are completed at the end of each accounting period after your adjusted trial balance has been run.

- To determine the income from the month of January, the store needs to close the income statement information from January 2019.

- Expense accounts have a debit balance, so you’ll have to credit their respective balances and debit income summary in order to close them.

- Such tasks include account reconciliation, adjusting journal entries, reviewing financial statements, and preparing reports for management.

- Closing entries are journal entries created at the end of an accounting period to transfer your temporary account balances into one permanent account.

Instead, as a form of distribution of a firm’s accumulated earnings, dividends are treated as a distribution of equity of the business. Making a closing schedule is the first step in executing the month-end close successfully. Because you have so much going on each month, there’s a likely chance that your month-end close will be unorganized.

To close that, we debit Service Revenue for the full amount and credit Income Summary for the same. While creating a journal entry document, SAP S/4 HANA checks whether debit and credits are balanced and whether all accounting-relevant attributes are entered completely. The remaining balance in Retained Earnings is $4,565 (Figure 5.6). This is the same figure found on the statement of retained earnings. The fourth entry requires Dividends to close to the Retained Earnings account. Remember from your past studies that dividends are not expenses, such as salaries paid to your employees or staff.

From the income summary account to the retained earnings account of the balance sheet. The retained earnings account is reduced by the amount paid out in dividends through a debit, and the dividends expense is credited. After the posting of this closing entry, the income summary now has a credit balance of $14,750 ($70,400 credit posted minus the $55,650 debit posted). As mentioned, one way to make closing entries is by directly closing the temporary balances to the equity or retained earnings account.

Bank Ledger Account

Make any necessary adjustments to your books when you discover any missing or duplicate invoices. Verify that the transactions listed in the vendors’ statements match those in your record book by comparing them. It assists you in tracking down the account’s errors that need to be fixed. Once the discrepancies have been resolved, record any necessary adjustments to your records to reflect the correct transactions.

Bank Accounting is an integral part of financial accounting that deals with all accounting transactions relating to bank account movements. A manual posting in the general ledger will create a journal entry document without any connection to sub-ledgers or any business transactions entered in SAP S/4 HANA. General ledger account master data deals with accounting transactions. Especially how the SAP FICO end-user posts them and how then the system processes the posting. Trial Balance – This report shows you all the account balances of a company for a certain period.

firsttuesday Real Estate Dictionary – first tuesday Journal

firsttuesday Real Estate Dictionary.

Posted: Fri, 04 Dec 2015 19:13:41 GMT [source]

It ensures that all necessary tasks are completed and all accounts are reconciled. Companies are allowed to use FIFO for financial reporting and LIFO for tax reporting, according to IRS requirement. 2% cash discount if the amount is paid within 10 days, or the balance due in 30 days.

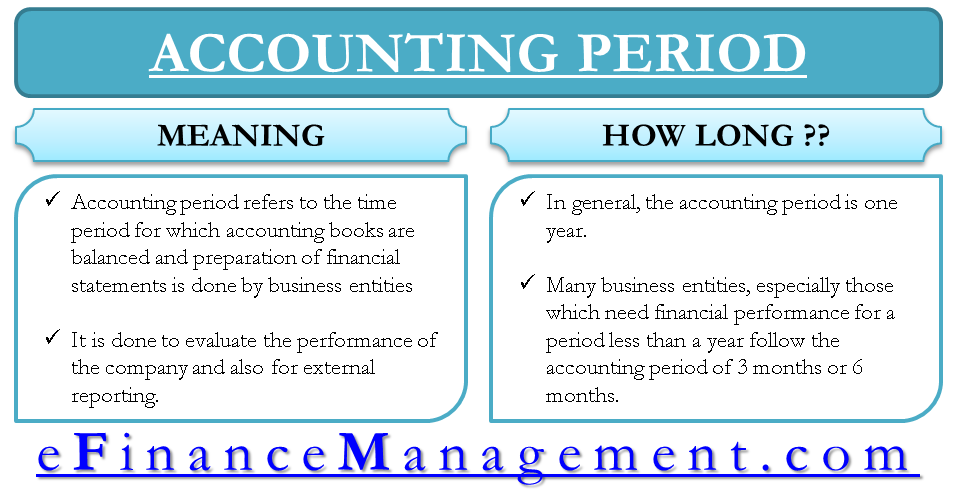

Companies are required to close their books at the end of each fiscal year so that they can prepare their annual financial statements and tax returns. Expense accounts have a debit balance, so you’ll have to credit their respective balances and debit income summary in order to close them. This time period, called the accounting period, usually reflects one fiscal year. However, your business is also free to handle closing entries monthly, quarterly, or every six months.

Once all of the required entries have been made, you can run your post-closing trial balance, as well as other reports such as an income statement or statement of retained earnings. So, if the closing entries journal is not posted, there will be incorrect reporting of financial statements. And not having an accurate depiction of change in retained earnings might mislead the investors about a company’s financial position. Of ₹ 5,00,000, which needs to be credited and then directly debiting the retained earnings account. Since the dividends account is not an income statement account, it is directly moved to the retained earnings account. In a sole proprietorship, a drawing account is maintained to record all withdrawals made by the owner.

Biden-Harris Administration’s Policies and Priorities – Trending Topics – Morgan Lewis

Biden-Harris Administration’s Policies and Priorities – Trending Topics.

Posted: Thu, 22 Apr 2021 14:22:05 GMT [source]

You can do this by debiting the income summary account and crediting your capital account in the amount of $250. This reflects your net income for the month, and increases your capital account by $250. Ledger AccountsLedger in accounting records and processes a firm’s financial data, taken from journal entries. Income summary effectively collects NI for the period and distributes the amount to be retained into retained earnings. Balances from temporary accounts are shifted to the income summary account first to leave an audit trail for accountants to follow.

Therefore, it will not appear on any trial balances, including the adjusted trial balance, and will not appear on any of the financial statements. First, all the various revenue account balances are transferred to the temporary income summary account. This is done through a journal entry that debits revenue accounts and credits the income summary.