Contents:

Your inventory is your lifeblood, so it’s essential you manage it accordingly. When you don’t sell enough products, your days might be numbered. When you sell a lot, but aren’t able to restock, you will also take a financial hit.

There’s no doubt that the more accurate you can make your accounting, the more you will set yourself up for success in the future. These all need to be counted and tracked in your inventory accounting system. Gradually move to the cost of goods sold account as an expense on the profit and loss statement as your business makes sales to customers.

Why is bookkeeping important for a small business?

Being able to track your company’s finances, keep an eye on cash flow, and be prepared for taxes are all critical to the success of any small business. However, using QuickBooks® or Excel spreadsheets for handling your bookkeeping and accounting isn’t ideal for managing finances and driving business insights for the future. Franchise bookkeeping services can help franchisees to make better decisions about their business. Franchising has become an increasingly popular way for entrepreneurs to start and operate a business. One of the main advantages of franchising is that it provides a proven business model and support from a well-established brand. However, franchisees still need to manage their finances effectively to ensure their business remains profitable.

Xendoo period costs a range of pricing plans, starting at $195 per month. The service also offers a custom pricing plan for businesses with more complex financial needs. The pricing plans include all the features mentioned above, making it easy to choose the plan that best suits your business needs and budget. Small business owners want to ensure that their operations are legal from the beginning. But, it is possible that you may not know what legal obligations you have.

- This looming stress can understandably sour people on bookkeeping altogether, but once it’s finally all sorted it’ll feel like a massive load off.

- Outsourced bookkeeping services are another option and typically charge monthly fees starting at $99 per month.

- By managing transactions and reconciliation avoids financial issues later on.

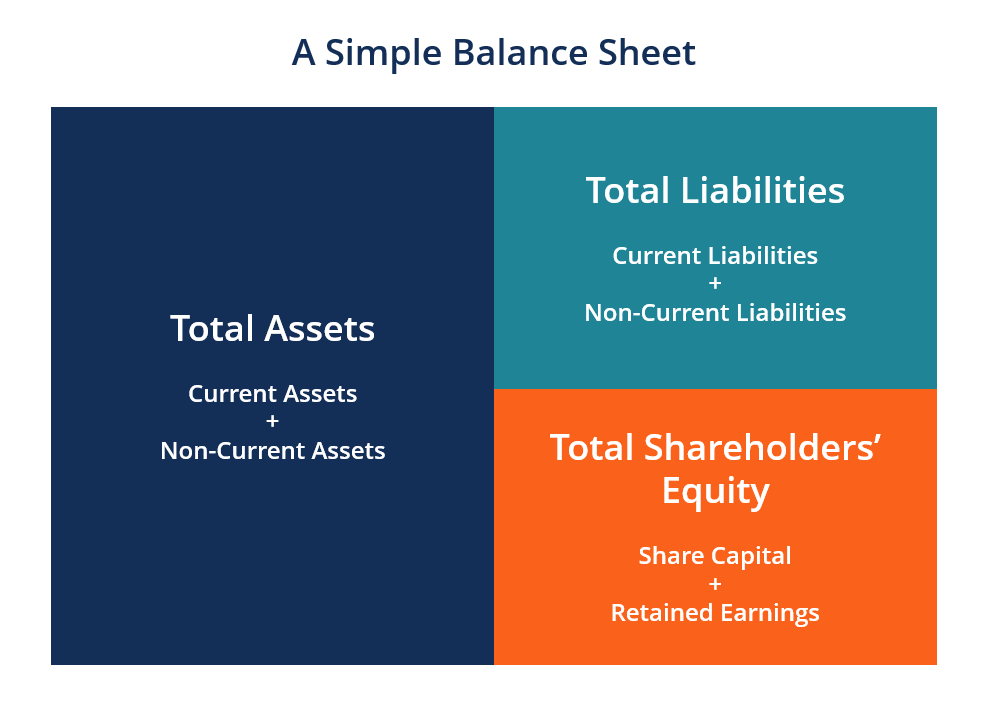

Without clean financial records, you may be at risk of paying settlements or tax penalties for avoidable financial errors. You also may be able to prevent or uncover fraud, whether from customers, vendors, or employees. Bookkeeping is essential to the vitality and long-term success of any small business. Primarily, you need to have an accurate picture of all the financial ins and outs of your business. From the cash you have on hand to the debts you owe, understanding the state of your business’s finances means you can make better decisions and plan for the future. You have been recording journal entries to accounts as debits and credits.

Double-entry bookkeeping versus single-entry

With the improvements in today’s technology, real estate bookkeeping has gotten substantially easier to do the help of online resources. By law, it is required that businesses keep up-to-date and standardized records of all money going in and out of their company. Online bookkeeping keeps a more accurate track of daily expenses so that you have one less thing to worry about – similarly to the way a virtual assistant would be helpful. It automates many of the manual tasks involved in accounting, such as data entry and bank reconciliation. It can also provide valuable insights into your business’s financial health, such as profit and loss statements and cash flow reports.

Small Business Accounting Archives – Small Business Trends

Small Business Accounting Archives.

Posted: Tue, 15 Mar 2022 18:03:09 GMT [source]

When it comes to https://1investing.in/ season, many people dread the thought of preparing and filing their taxes. The process can be complicated and time-consuming, and mistakes can lead to costly penalties. Our tax preparation services can help you get your taxes done right and on time, so you can avoid the stress and hassle of doing it yourself. Receipts — Keeping receipts for all financial transactions is essential to maintaining accurate records. Accounting Software — Accounting software can help you automate many bookkeeping tasks, such as invoicing, expense tracking, and financial reporting.

Calculating Costs

He has worked diligently with thousands of IBOs, from those just getting started to those at the Diamond level and above. In this guide, Joe shares with you the same insights he offers to his clients. Bookkeeping is a critical part of any business and will impact the growth and success of it. Bookkeeping encompasses a variety of tasks — from basic data entry to working with your accountants / tax professional. A great time to separate these accounts is when you officially file for an LLC, S Corp, or other business entity. By doing so, you will be required to file your business taxes separately from your personal ones.

With the evolution of technology, professions—including bookkeeping—have been revolutionized. It’s challenging to keep track of data in two-dimensional accounting systems, especially when there’s no guarantee of accuracy. The general ledger and project ledger do not tie together, so your business stays in a constant state of reconciliation.

Basically, cash accounting recognizes revenue and expenses right away, while accrual accounting places focus on the anticipated revenue and expenses. 1) Cash Accounting – This is a quick way to recognize revenue and expenses. This is a more straightforward accounting method that recognizes income only when you receive it, such as when it enters your bank account. 1) Single Entry – This system of bookkeeping involves making an entry for every single financial transaction your business conducts.

A Small Business Guide to Payroll Management – The Motley Fool

A Small Business Guide to Payroll Management.

Posted: Fri, 05 Aug 2022 07:00:00 GMT [source]

With this credit, you can get up to $26,000 back per employee during COVID-19. However, for the novice, the introduction of bookkeeping-specific vocabulary and the rules that govern proper bookkeeping processes can be overwhelming. An example of an expense account is Salaries and Wages or Selling and Administrative expenses.

Kathleen’s guide to purchase orders, bills, expenses, estimates, and invoices—all specific to the complex world of interior design. Bookkeeping, in general, doesn’t add anything to the bottom line, so it doesn’t feel as important as other activities. It also just isn’t as much fun as coming up with a new product idea or marketing campaign, and it’s more stressful than doing some filing or ordering office supplies. When readers purchase services discussed on our site, we often earn affiliate commissions that support our work. Tools and resources built to empower the financial well-being of your small business, driven by the financial experts at Ceterus.

Remembering cousin Jacqueline Barton – Red Bluff Daily News

Remembering cousin Jacqueline Barton.

Posted: Sat, 04 Mar 2023 08:00:00 GMT [source]

The chart of accounts may change over time as the business grows and changes. As you record these transactions, make it a habit to assess them. For example, if you’re making a loss in Facebook ads, it may be time to stop spending it and explore other marketing channels. At this stage, you will want to invest in a quality bookkeeping software.

The introduction of information systems to support accounting has significantly reduced the overhead involved in bookkeeping. Optical character recognition and bank feeds have made it easier for companies to automate their bookkeeping processes. Just as there is a right way to do restaurant accounting, there is definitely a wrong way. We’re going to assume you’re not an accountant (if you are, you’re probably not reading this article), and so we’re going to tell you some common mistakes to avoid, too.

It’s also a good idea to become familiar with the accounts included in your chart of accounts, which will make it much easier when you begin to enter financial transactions. At the end of the appropriate time period, the accountant takes over and analyzes, reviews, interprets and reports financial information for the business firm. The accountant also prepares year-end financial statements and the proper accounts for the firm.